Analyzing Real Estate Market Numbers in 2022

The Washington Center for Real Estate Research at the University of Washington provides one of my favorite charts for analyzing the state of the local real estate market. It is the housing affordability index, which is released quarterly and delivers housing affordability statistics by county. To understand how the measurements function, the WCRER describes it like this:

The Housing Affordability Index measures the ability of a middle-income family to carry the mortgage payments on a medium price home. When the index is 100, there is a balance between the family’s ability to pay and the cost. Higher indexes indicate housing is more affordable.

WCRER’s index takes into consideration housing prices, incomes, interest rates, inflation, and the ability to save for down payment, etc. As economic conditions change, so does the index. Simply put, if the index is above 100, housing is affordable to middle income families. If the index is below 100, it is not. The lower the index, the less affordable housing is to middle income families.

The problem we are facing in the real estate world today is affordability. I have prepared a chart that shows how closed real estate transactions in Snohomish County nearly mirrors the WCRER affordability index for the past five years. The most recently released index number in Snohomish County stands at 60 and real estate transactions are following suit, as is to be expected. Home sales in Snohomish County are down nearly 13% over this time last year. Ten percent of that took place in the last two months.

The Big Three and Their Affect on the Real Estate Market

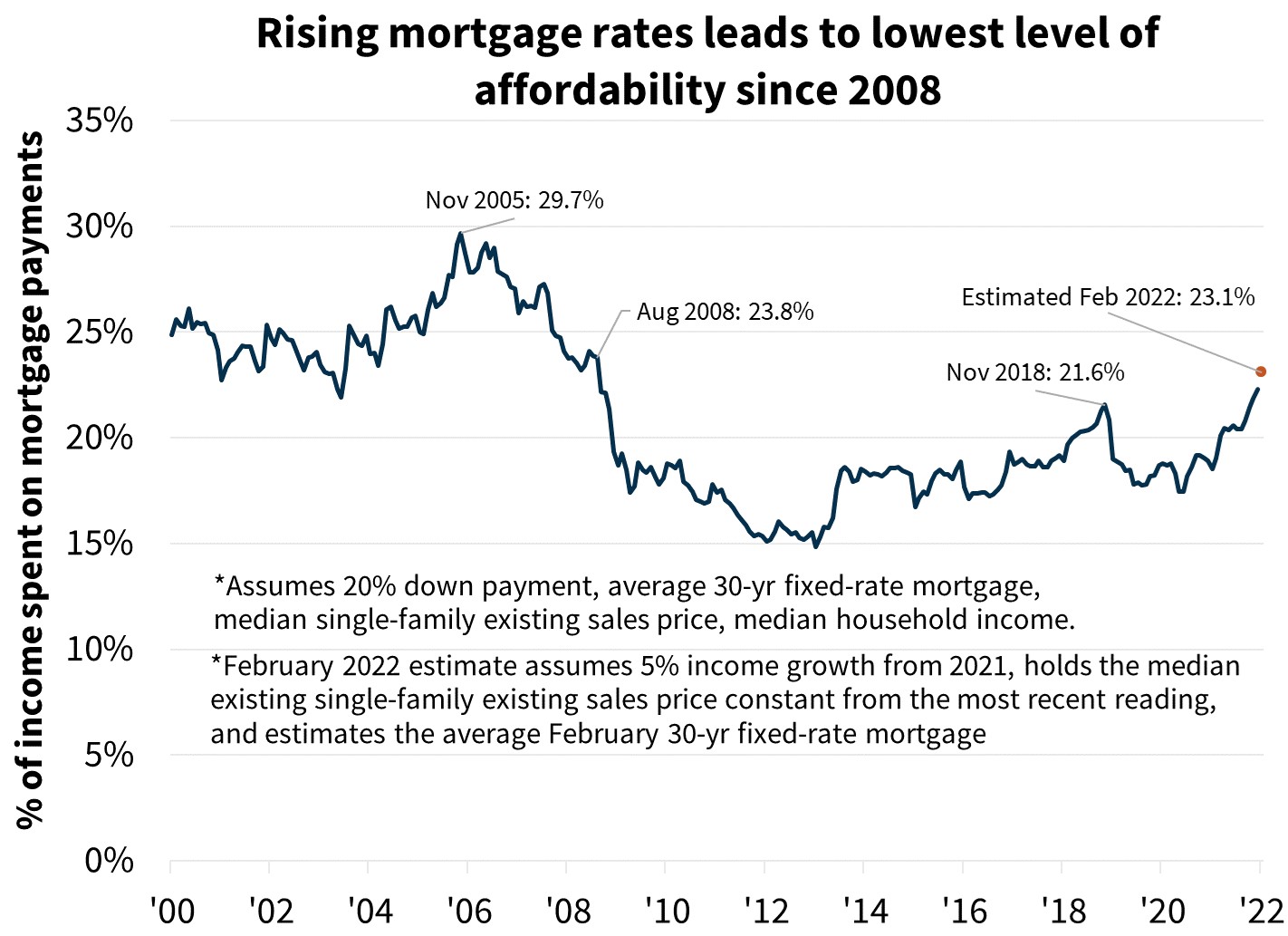

The main drivers of these statistical changes in real estate market affordability are what I call the Big Three: Wages, Interest Rates, and Home Pricing. Housing prices have soared for the past decade, driven by low inventory and low interest rates, causing many buyers to be priced out of the market. However, interest rates have doubled in the last year and now more buyers have been removed from the market. The result: the real estate market has slowed dramatically.

Interest rates

As in any free market economy, market forces shape supply and demand for products and commodities. In our current economic situation, we are seeing inflation at 40-year highs. To counteract this, the FED is taking action to get inflation under control by way of raising interest rates. Unfortunately for the real estate market, this solution is meant to curtail consumer spending and runaway pricing. In my opinion, this is not a short-term solution. It takes time for higher interest rates to make a dent on inflationary pressures. Home buyers should not be looking for interest rates to be lower any time soon.

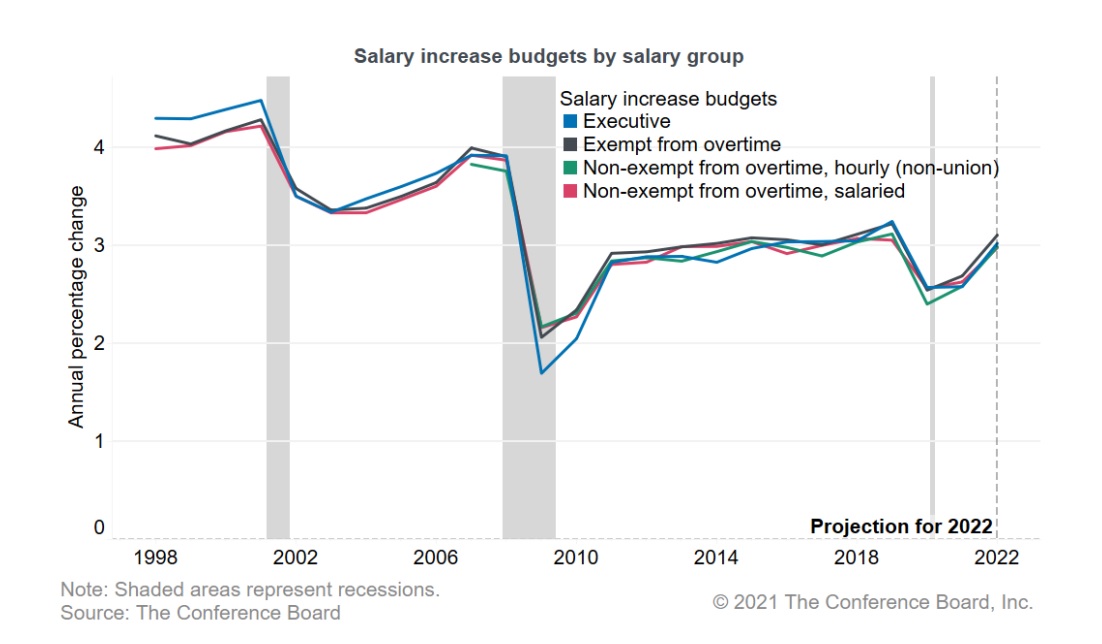

Wages

Wages will continue to rise as they have since the dawn of time. However, this too is a long-term solution to the housing affordability problem. Wages rise, but slowly. The average increase in annual salary has averaged about 3% for decades. It is estimated that 2022 will be no different. The problem remains that a 3% salary increase does not compensate for interest rates that have doubled, inflation running at around 8% and housing prices at all-time highs.

Housing Prices

In order to bring the housing affordability Index numbers back in line, something has to give. Market forces start working whether we like it or not. In the case of the real estate market in Snohomish County, we know that we cannot count on interest rates to come in lower in the near term and we know that wages are not keeping pace with inflation or interest rates. All that’s left to compensate for our affordability condition is housing prices, and we are currently seeing downward pressure. The last two months alone have seen a decline of 10% in housing prices in Snohomish County.

Is the Current Real Estate Market Good or Bad?

Are housing prices dropping in our county a good or bad thing? In my humble opinion, it is neither good, nor bad. It is just market forces recalibrating affordability. It is the nature of a free market economy. I see this as the only choice, in the near term, for housing affordability and the real estate market, to reset itself and return to a normal state. I do not see an impending market crash coming like the one the market experienced in 2008. I see this as a minor correction in pricing until affordability numbers align themselves again. I don’t expect this to last long. Nor do I think prices will continue to fall significantly. So, if you’re waiting for housing prices to drop considerably before you purchase, you will probably be missing a great buying opportunity.

If you are thinking of selling soon, you may have to face a new reality. The market conditions respond to market forces. It’s impossible to time the market and in the end, we are all on the same ride. It’s neither good nor bad, it’s just the way it is.

Written by Owner Chris Hill

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link