The Power of Strategy with 1031 Exchanges

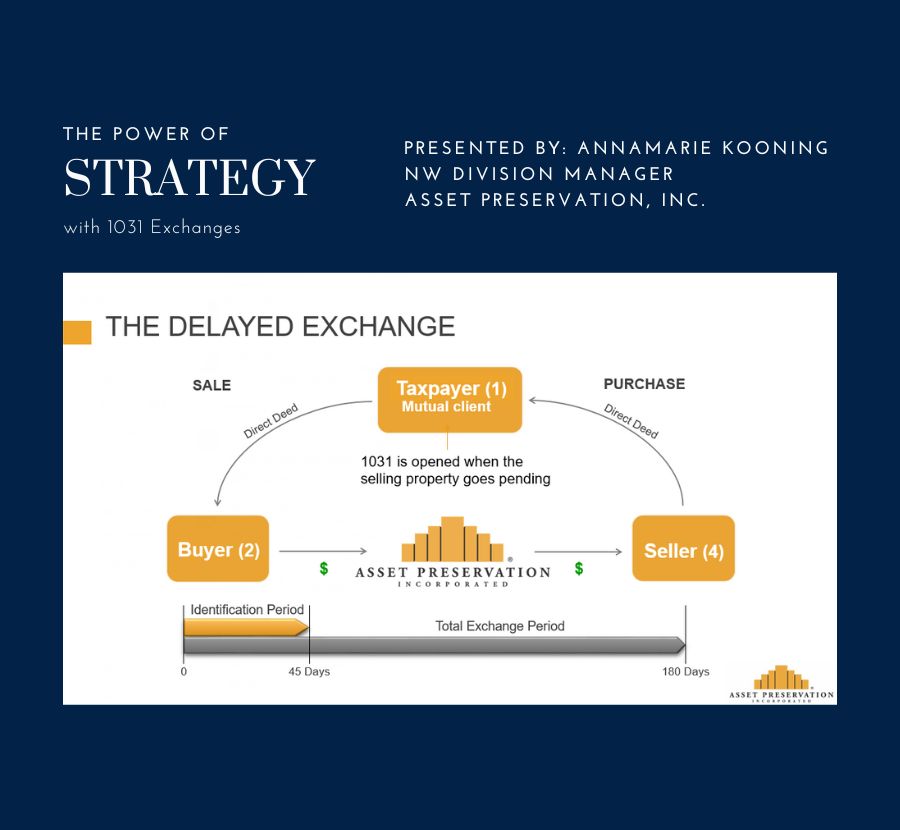

We recently had the pleasure of hosting a seminar on wealth preservation led by Annamarie Kooning, the NW division manager of 1031-Asset Preservation Inc. The topic was especially relevant in that we have experienced unparalleled real estate appreciation for the last decade, with the drawback being the tax implications when selling a long held real estate asset.

Credit: ANNAMARIE KOONING | NW Division Manager | Asset Preservation, Inc. | The Power of Strategy with 1031 Exchanges

1031 Tax Deferred Exchange Defined

A 1031 tax deferred exchange is a powerful tax strategy that allows real estate investors to defer paying capital gains taxes on the sale of an investment property, provided they meet certain IRS requirements.

Here four benefits of a 1031 exchange:

1. Tax Deferral: The biggest benefit of a 1031 exchange is the tax deferral. By exchanging a property instead of selling it, an investor can defer paying capital gains taxes on the sale, potentially indefinitely. This allows the investor to keep more of their proceeds working for them, and to defer paying taxes until a later date.

2. Increased Buying Power: Another advantage of a 1031 exchange is that it allows investors to use the equity in their property to purchase a more valuable property, without having to pay taxes on the sale of the first property. This can increase the investor’s buying power and enable them to purchase a property that may generate more income or appreciate more quickly.

3. Diversification: A 1031 exchange also allows investors to diversify their real estate holdings. By exchanging one property for another, an investor can adjust their portfolio to better meet their investment goals, such as increasing cash flow, reducing risk, or capitalizing on emerging trends.

4. Estate Planning: Finally, a 1031 exchange can also be a useful tool for estate planning. By deferring taxes on a property, an investor can pass it on to their heirs without having to pay capital gains taxes. This can help to preserve the investor’s wealth for future generations.

Contact Us To Connect With A 1031 Exchange Expert

Overall, a 1031 exchange can be a powerful tax strategy for real estate investors, allowing them to defer taxes, increase buying power, diversify their holdings, and plan for the future.

Contact us for more information, or for an introduction to our 1031 tax code expert, Annamarie Kooning. It may save you thousands of dollars.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link