Free Christmas Events 2024

FREE Christmas Events 2024

Get ready to make your 2024 holiday season magical with these FREE Christmas events! From sparkling light displays and festive gatherings to elaborate gingerbread houses, there’s something for everyone to enjoy. Create cherished memories, soak in the holiday spirit, and celebrate the season without spending a dime!

Selfies with the Grinch brought to you by Windermere Mill Creek

Windermere Mill Creek 15418 Main St, Suite M103 Mill Creek WA 98012

Saturday, December 7th

1:00 pm – 3:00 pm

Get ready to capture some holiday fun! Join us at the Windermere Mill Creek Town Center location on Saturday, December 7th, from 1:00 PM – 3:00 PM for selfies with the Grinch. Bring your own camera and strike a pose with everyone’s favorite holiday Cheermeister—perfect for a festive keepsake or a unique holiday card! Don’t miss this whimsical photo-opportunity to kick off the season with a little holiday cheer. The Grinch will be wrapping up photos at 3:00 and heading over to the Mill Creek Town Center Santa Parade, so if you arrive after beware- even if he wanted to take more photos, his schedule wouldn’t allow it.

Irwin Family Lights

10513 27th Dr SE, Everett, WA 98208

The show usually runs nightly from December 1st until New Years Eve 5-10 pm

The Irwins work year-round, crafting props and planning their show, which can be enjoyed through yard speakers (until 9pm) or by tuning to 87.9 FM (until 10pm). Their dedication brings joy to visitors, with many calling it a beloved family tradition.

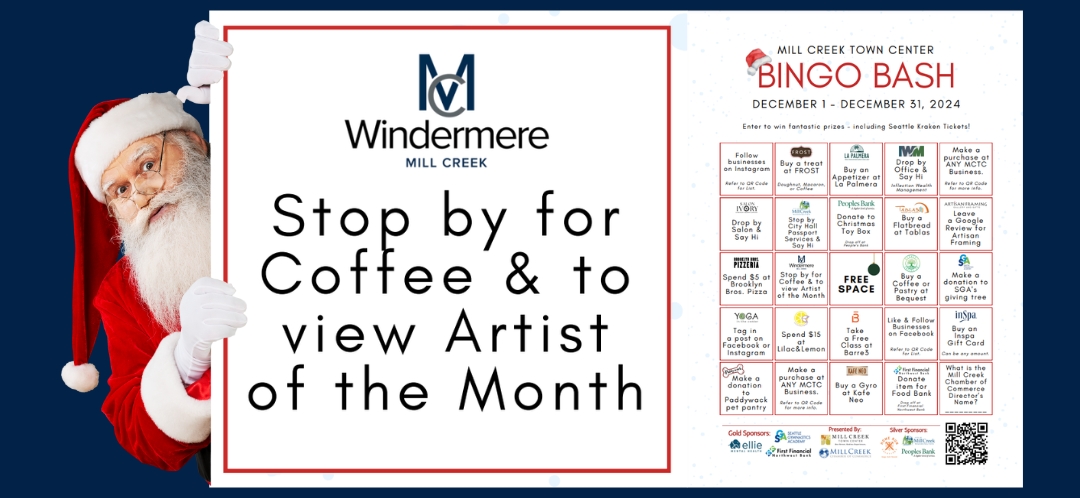

Mill Creek Town Center Bingo Bash

Mill Creek Town Center

December 1st – December 31st, 2024

Win amazing prizes while supporting local businesses! Get ready for a festive adventure this December! The Mill Creek Town Center Bingo Bash is your chance to explore local businesses, support your community, and win fantastic prizes – including 4 tickets to a Seattle Kraken game in January (for cards with a full blackout). Download your Bingo Bash card here.

Evergreen Christmas Light Show hosted by Evergreen Church

Evergreen Church

3429 240th St SE, Bothell, WA 98021

December 1st – December 24th, 2024

6:00 pm – 9:00 pm

Brighten your winter nights at the Evergreen Christmas Light Show! Enjoy FREE cookies in a heated viewing area as you watch the 30-minute music-choreographed light show, running continuously from 6:00–9:00 PM. Explore festive displays, including a snow-dusted light tunnel and indoor train village. Learn more at Christmas at Evergreen.

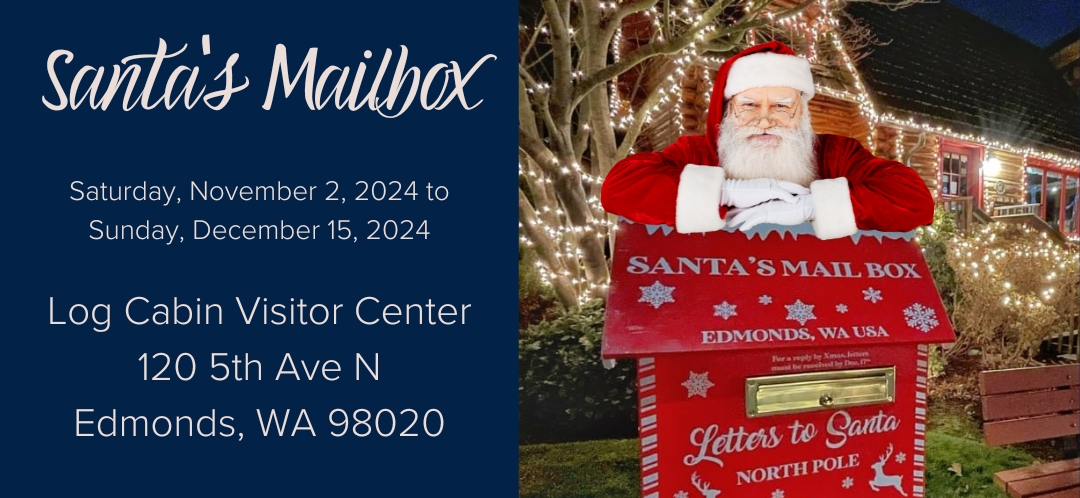

Santa’s Mailbox

Log Cabin Visitor Center | 120 5th Ave N. Edmonds, WA 98020

November 2nd – December 15th, 2024

“In this town, the Letters to Santa get answered with a personal reply. Drop yours in the red mailbox in front of the Log Cabin Visitor’s Center by December 15th to hear back from the guy in red!”

Sheraton Grand Seattle Gingerbread Village

Sheraton Grand Seattle 1400 6th Ave, Seattle, WA 98101

November 21st, 2024 – January 1st, 2025

Sunday – Thursday : 9:00 AM – 9:00 PM & Friday – Saturday: 9:00 AM – 11:00 PM

Learn more at: gingerbreadvillage.org

The 30th Annual Sheraton Grand Seattle Gingerbread Village is back with this year’s theme: Iconic Destinations! Each display showcases stunning creativity, making it a must-see holiday tradition. I’ve visited the Sheraton Gingerbread Village many times over the years, and it’s always a highlight of the holiday season. The artistry and attention to detail never fail to amaze! While free to attend, donations are welcomed to support the Juvenile Diabetes Research Foundation’s Northwest Chapter. Celebrate the season and give back to a great cause!

Snowflake Lane

Bellevue Square: On the sidewalks between Bellevue Square and Lincoln Square from NE 4th to NE 8th Street

November 29th – December 24, 2024

Nightly starting at 7:00 pm

Free Parking can be found at The Bellevue Collection Parking Garages but I highly recommend you arrive early!

Snowflake Lane’s enchanting parade is back this year! Enjoy complimentary delights, including character performances, dazzling floats, twinkling lights, and nightly snowfall. Arrive early to secure free parking in the Bellevue Collection Parking Garages and snag a front-row spot along the sidewalk. And don’t forget to bundle up—it was freezing when I went last year! And as an added tip, if you’re going with little ones bring along some glow sticks and light up gear to help make the street even brighter! Stay cozy and enjoy the magic!

The Fairmont Olympic Hotel Teddy Bear Suite

411 University St, Seattle, WA 98101November 29th – January 2nd, 2025

10:00 AM – 5:00 pm

Step into the magical Teddy Bear Suite at the Seattle Fairmont Olympic Hotel! Located on the second floor, this cozy, family-friendly event is perfect for holiday photos. Admission is free, with donations benefiting Seattle Children’s Hospital and the Festival of Trees.

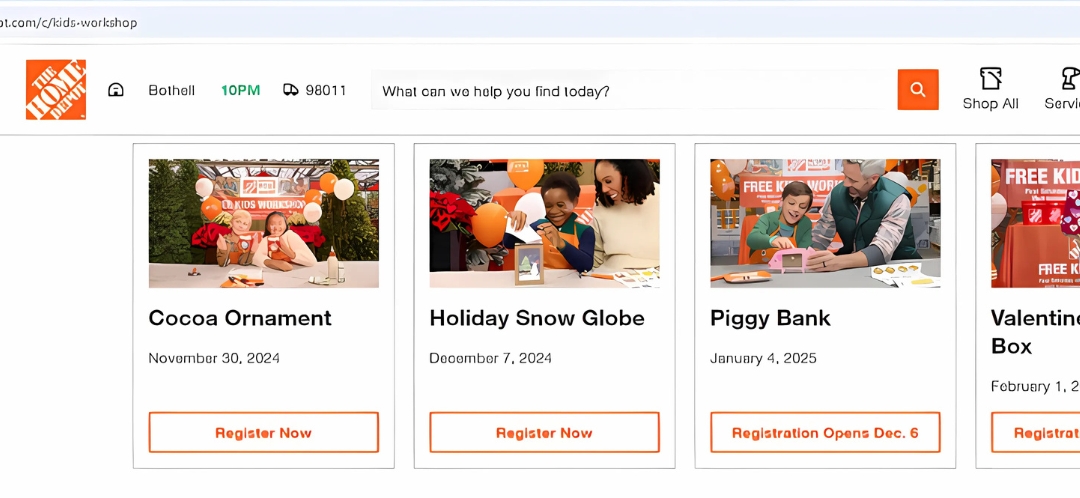

Kids Holiday Workshops at The Home Depot

Your Local Home Depot

Cocoa Ornament- November 30th

Holiday Snow Globe- December 7th

*These events are FREE with registration while supplies last*

The Home Depot is hosting two free kids’ workshops this holiday season! On November 30th, make a cocoa ornament, and on December 7th, build a Snow Globe. Supplies are limited, so register online here to join the fun!

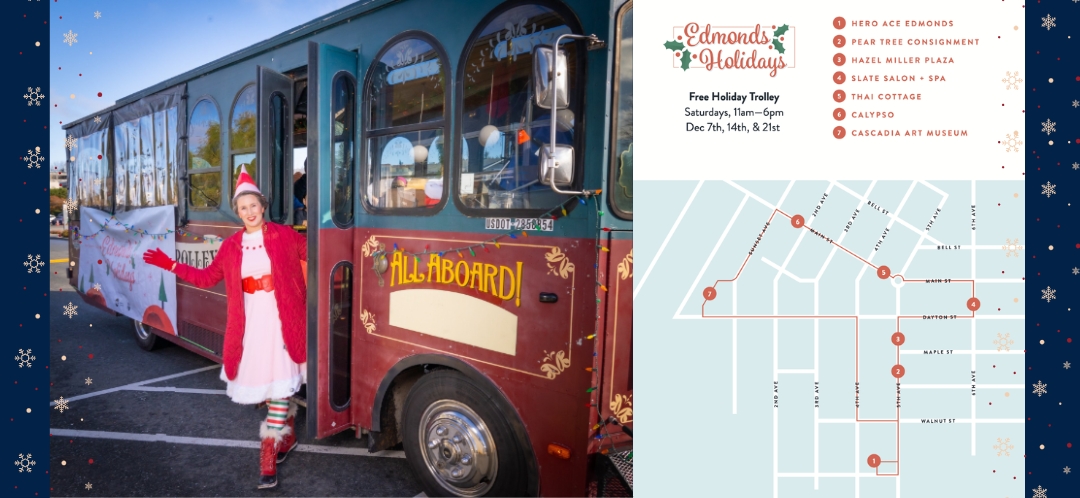

Edmonds Holiday Trolley with Emily the Elf (and Scott)

The trolley runs every 30 minutes on Saturdays 12/7, 12/14 & 12/21st from 11am to 6pm

This year marks Emily’s 10th season spreading holiday cheer in Edmonds, where she’ll ride the free trolley handing out candy canes and stickers, adding an extra sparkle to the festivities. The trolley runs every 30 minutes, December 7th (with Scott the Elf subbing), 14th, and 21st, from 11 AM to 6 PM. No food or drink is allowed on the trolley though, so plan a few stops around downtown Edmonds to grab holiday treats!

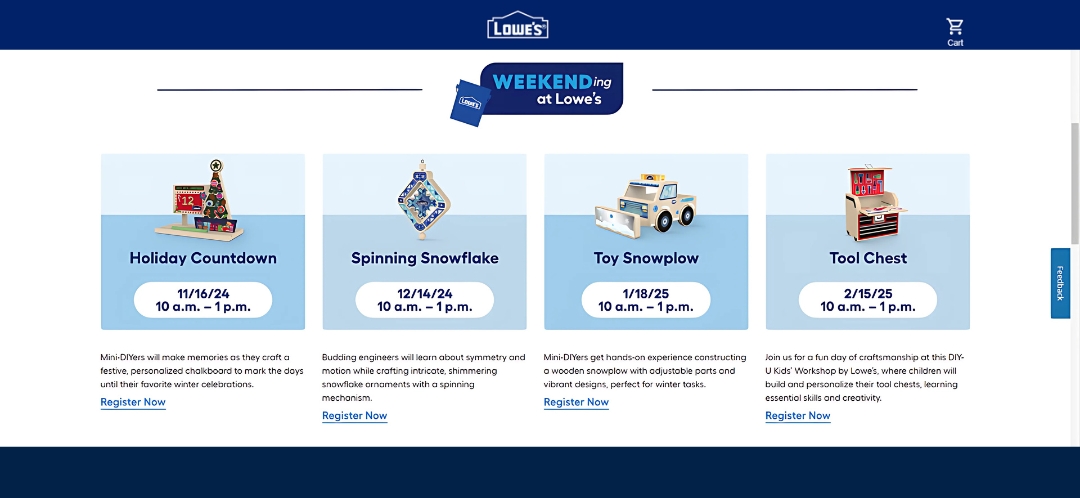

Lowes Holiday Kids DIY Events

You must pre-register for these events and then head to your local Lowes on the day of, WITH your email confirmation, to participate!

Lowe’s is inviting all little elves to team up with their merry Red Vest experts for this year’s exciting kids’ workshops! This season, kids can build a spinning snowflake or a toy snowplow, perfect for holiday fun and creativity. These free events require registration, and participants must present a confirmation email on the day of their DIY. Spots are limited and available only while supplies last. Don’t miss out—head over to Lowe’s website HERE to register your little ones today!

Mill Creek Santa Parade

Mill Creek Town Center starting near L.A. Fitness – 15024 Main St.

December 7th

Parade 3:30 pm – 4:00 pm ; there are other festive free events running from 1:00 pm – 6:30 pm at The Mill Creek Town Center

Get ready to grab a hot chocolate and feel the holiday cheer because Santa is making his way to the Mill Creek Town Center! Here’s what’s in store for this festive day:

1:00 pm – 3:00 pm Activities at Town Center Businesses (stop by our office, Windermere Mill Creek, to take a selfie with the Grinch!)

3:30 pm Santa Parade on Main Street

3:30 – 6:30 pm Santa’s Village Vendor Market

5:00 pm Tree Lighting at City Hall South

5:15 – 6:30 pm Santa Pictures presented by State Farm Chris Jones

All day: pick up your BINGO Bash card at participating businesses

Bring your holiday spirit and join the fun—it’s a day full of festive excitement for the whole family!

Check out Your Local Tree Lighting Event!

Snohomish County Wide | Dates Vary

- Monroe November 22nd from 5:30 PM-8:00 PM at Loranger Square

- Everett November 29th from 2:00 pm – 8:00 pm at Downtown Everett, intersection of Colby & Hewitt

- Snohomish November 30th from 2:30 pm – 5:00 pm at Snohomish Carnegie Building

- Arlington November 30th from 4:00 pm – 7:00 pm on Olympic Ave, Downtown

- Edmonds November 30th from 2:00 pm – 5:00 pm at Centennial Plaza – 5th Ave. N. & Bell St. in Edmonds

- Mount Lake Terrace December 6th at 6:00 pm at City Hall – 23204 58th Ave. W.

- Port of Everett December 7th from 12:00 noon – 6:00 pm at the Port of Everett Waterfront – Pacific Rim Plaza, 1028 13th Street, Everett, WA 98201

- Marysville December 7th from 4:00 pm – 8:00 pm at Comeford Park 501 Delta

- Lake Stevens December 7th from 4:00 pm – 7:00 pm at North Cove Park – 1806 Main St, Lake Stevens, WA 98258

- Mill Creek December 7th 3:30 pm – 5:30 pm at City Hall South – 15728 Main St. Mill Creek, WA 98012

- Woodinville December 7th from 3:00 pm – 6:00 pm in DeYoung Park

- Stanwood December 7th from 3:00 pm – 7:00 pm at 8727 271st St NW, Stanwood

- Granite Falls December 7th 5:00 PM at City Hall – 215 S Granite Ave

- Mukilteo December 7th TBA

- Lynnwood TBA

As the season of joy and togetherness unfolds, I hope this guide to free Christmas events adds a sprinkle of magic to your holiday plans.

Whether you’re marveling at dazzling light displays, crafting festive keepsakes, or enjoying heartwarming community traditions, may your days be merry and bright. Wishing you a very Merry Christmas and a Happy Holiday season filled with love, laughter, and cherished moments!

Kerriann Jenkins

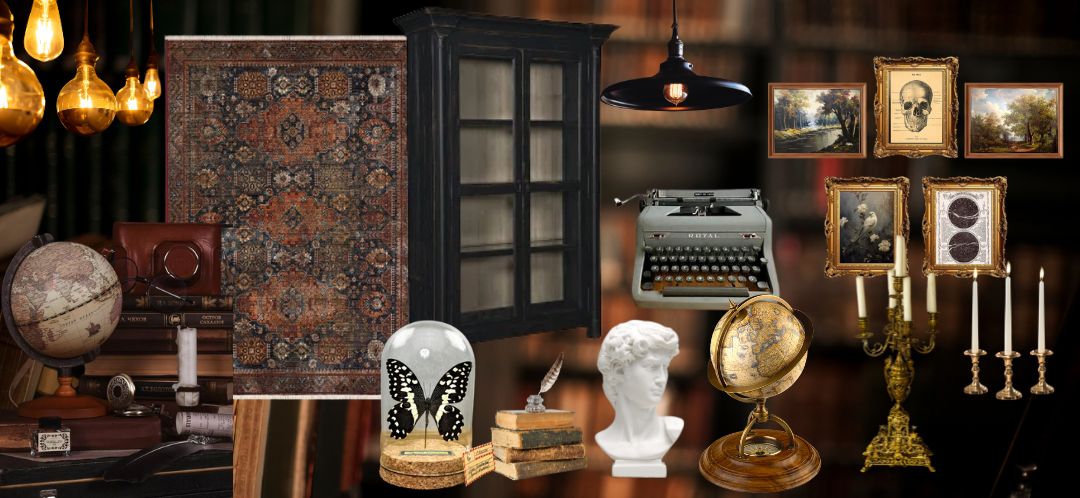

Moon Garden

Moon Garden

Picture this: You’ve had a long day at the office, checked off your errands, and wrapped up all your social obligations. Now, you’re finally home. Where do you imagine winding down and enjoying your evening? Chances are that your garden wasn’t the first thing that popped into your mind. But what if it could be? Enter the Moon Garden, a serene escape where your outdoor space comes alive after dark, glowing under the soft light of the moon.

What is a Moon Garden?

A Moon Garden is purposefully designed to be enjoyed at night, featuring an array of white and silver-toned plants chosen for their ability to reflect the moonlight. Often, fragrant flowers are included, adding a sensory dimension that heightens the experience.

Why Design a Moon Garden?

Let’s face it—most of us don’t get that much time at home. The average person spends around 2,092 hours a year at work. Add the hours spent commuting, running errands, and socializing, and suddenly the time you have to enjoy your garden shrinks even more. That’s where a moon garden shines (literally!). It’s a space you can enjoy in the evening, offering calm when the world quiets down. Plus, it has the added perk of attracting night pollinators like moths and bats, drawn to the reflective glow of white flowers.

How to Plan Your Layout

Start by walking around your yard at night to see where the moon naturally casts its light. Keep in mind the moon’s position changes throughout the month, so choose a spot that will get light at different times. Make sure this space is visible from a window or seating area so you can appreciate it both indoors and out. Start small: You don’t need to overhaul your entire backyard. Begin with a cozy corner or a flower bed and build on it over time. If you prefer low maintenance, select plants that don’t require deadheading, or major upkeep. Layer your plants: Combine ground covers, medium-height flowers, taller shrubs, and flowering trees to create depth and dimension. The more variety in height, the more striking the moonlit effect will be.

Choosing Moon Garden Plants

The goal is to choose plants that have white or pale flowers and silvery foliage. Some plants even bloom under moonlight, adding an extra touch of magic. Remember, plants bloom at different times, so try to pick varieties that will give you something to enjoy in every season. Here are some examples to consider:

Creating a Space That Shines When the Rest of the World Fades Into Darkness

You can also enhance the space with cozy seating and soft lighting for those nights when the moon isn’t as bright. This way, your garden is a perfect retreat every evening, no matter what the moon phase. A moon garden is more than just a beautiful space; it’s a sensory experience. It invites you to slow down and savor the sights, smells, and sounds of the evening. Whether you’re looking for a peaceful spot to meditate, a romantic hideaway, or simply a magical garden that glows under the stars, a moon garden delivers. With just a little planning, you can turn a corner of your yard into a nighttime haven. So, the next time the sun sets, and the moon rises, step outside and let your moon garden welcome you to a peaceful, enchanting retreat.

Kerriann Jenkins

Scent Nostalgia & Home Staging

A recent trip to Disney World made me realize the incredible power of scent nostalgia in evoking positive emotions and memories.

If you’ve ever been, you know exactly what I mean. Think about the warm aromas of pastries, coffee, and hot buttered popcorn wafting down Main Street. The salty, tropical, and floral breeze on Avatar Flight of Passage. The smoky, musty, and damp smell on Pirates of the Caribbean. Even my hotel room at Port Orleans Riverside had a delightful blend of fresh linen, citrus, and florals. Nobody tells a scent story quite like Disney. But with these tips, you can bring a touch of that scent nostalgia magic to create a similar feeling for homebuyers when staging your home.

First, start by thoroughly cleaning to remove old scents.

Ensure the home is spotless to eliminate any lingering odors before introducing new scents. This means deep cleaning carpets, drapes, upholstery, and air ducts, as well as using odor-neutralizing products like DampRid to create a fresh, clean slate. Make sure to leave enough time between cleaning and the open house for strong scents like bleach to dissipate.

Subtlety is key.

Avoid overpowering scents, as they can be off-putting or cause allergies. Strong scents are often used to mask bigger issues like mold, and their presence can alarm prospective buyers. Keep scents subtle and natural to create a welcoming atmosphere without being overwhelming.

Focus on key areas.

Concentrate on high-traffic areas where buyers are likely to spend more time, such as the entryway, living room, and kitchen. These areas are where the impact of scent nostalgia can be most effective. Also, avoid introducing too many scent stories, as this can be overwhelming.

Identify nostalgic scents and consider the target market.

This step can be tricky but is crucial. Think about scents that commonly evoke nostalgic feelings, such as fresh-baked cookies, citrus, and linens. Be cautious about introducing strong scents like heavy perfumes, as they might not appeal to everyone and could turn buyers away.

Use natural elements to your advantage.

Placing scents where they would naturally occur can add a pleasant fragrance experience without making the home feel artificial. Use items like fresh flowers and citrus bowls around the home.

Seasonal scents can easily create scent nostalgia.

Match scents to the current season. In fall, use scents like pumpkin spice or cinnamon. In winter, opt for pine, cranberry, or peppermint. Spring and summer scents could include floral fragrances, citrus, or fresh linens.

A well-ventilated home also helps with scent nostalgia.

Ensure the home is well-ventilated to avoid any stale or musty odors. Fresh air can be the best scent of all, giving the home a clean and inviting feeling.

Implementing these strategies can bring a touch of Disney’s magic into your home, creating an inviting and emotionally appealing atmosphere that enhances the overall staging.

Just as Disney uses scent nostalgia to transport you to a world of warm pastries, tropical breezes, and smoky adventures, you can evoke positive emotions and memories in potential homebuyers. By thoughtfully curating the scents in your home, you’ll help them envision a future filled with comfort and joy, making your property truly unforgettable.

Kerriann Jenkins

The Reptile Zoo

Do You Know The Reptile Man of The Reptile Zoo?

Have you ever heard a Gaboon Viper hiss a menacing Darth Vader breath into a microphone? I have. It’s a sound that lingered in my memory long after I’d heard it. My journey with Scott “The Reptile Man” Peterson began many years ago. I was at an elementary school assembly where he wowed and educated us with his interactive reptile presentation. He touted creatures from a tortoise to the second deadliest snake in the world, the Gaboon Viper. If you haven’t had the chance to witness one of these electrifying shows in person, fret not! You can visit his menagerie of reptiles at The Reptile Zoo, located in Monroe.

Situated right off Highway 2, The Reptile Zoo is impossible to miss.

Its plot of land practically kisses the roadside. Despite its modest size, I believe this zoo packs a punch. While an average visitor might breeze through in 30 to 45 minutes, my experience lasted longer. Accompanied by my enthusiastic budding herpetologist, my daughter, we delved deep into the world of scales and slithers. We spent somewhere around two hours exploring the exhibits. And truth be told, we could have easily stayed longer if time allowed.

Upon entering the zoo, we were met by a rush of humid, muggy air.

This provided support for the perfect captive habitat for the exotic creatures waiting within. If you’re not used to that kind of climate, I recommend you wear layers. That way you can peel off your jacket and adjust to your appropriate comfort level. Otherwise, it might not be an enjoyable experience for you.

On our most recent visit we were greeted almost immediately by a hands-on encounter.

There at the front of the room sat a 9-foot long Burmese Python and an American Alligator. Their handlers invited us to gently touch each creature. Which set the tone for a fun visit as on previous visits we were only able to gently touch the top of a few tortoise shells. Then purely by accident, I learned it is a poor idea to wear bright blue nail polish to the zoo because they shone like a beacon attracting reptilian curiosity. Reptile activity increased as I passed, and I quickly learned to put my fingers away. A few well-placed bobs and foot stomps from an Iguana, and an unexpected leap from a tiny alligator made me aware of my faux paus.

Apart from my unintentional breech of etiquette, we enjoyed our time looking at “the most extensive collection of reptiles on display in the Pacific Northwest.”

Just a few of the reptiles I saw while at the Reptile Zoo- including the Iguana I deeply offended with my blue polish.

From the marvel of a two-headed turtle to the ethereal beauty of an albino alligator, every corner of the zoo held a new wonder. While the rainy weather dashed our hopes of exploring the Tortoise Garden outdoors, we did take the time to visit each open exhibit twice, savoring every moment. We left feeling thoroughly satisfied, have gotten more than our money’s worth.

Having visited the Reptile Zoo multiple times now, it’s safe to say we’ll be making the drive again in the future.

Unlike larger more crowded zoos, this gem offers a leisurely pace. I found it allowed us to immerse ourselves in the marvels of the reptile kingdom without feeling overwhelmed for time. So, if you find yourself in the area, I wholeheartedly recommend experiencing this up-close encounter with reptiles at least once. Trust me, it’s an adventure you won’t soon forget!

Kerriann Jenkins

Cherry Blossom Trees at the University of Washington

Cherry Blossom Trees at UW

Here in Washington, we have a few celebrity flowers that have blossomed their own dedicated cult following. One of these blooms even has its own Twitter account and a year-round live feed webcam. That’s right! The beauty of the Cherry Blossom Trees at the University of Washington’s quad is a renowned crowd drawer.

A Guide to Visiting the UW Cherry Blossom Trees

Explore the beauty of the University of Washington’s Cherry Blossom Trees with my guide! Learn about when and where to view the blooming flowers, the history of the trees, and tips for making the best of your visit. Unforgettable photos, magnificent memories, and a unique experience await you at the UW Cherry Blossom Trees!

When do they bloom?

The UW Cherry Blossom Trees usually start blooming in mid-March and can continue through mid-April. Typically, peak bloom happens in the third week in March, according to UW arborist Sara Shores. But the exact timing of the blooms depends on the weather, so it can vary from year to year. It’s a gorgeous sight to see the campus in full bloom, so be sure to take some time to enjoy it when it happens!

The History of The UW Cherry Blossom Trees

The true origin story of the UW Cherry Blossom Trees has been lost to time and myth. One consistent is that the trees arrived in Washington sometime in the early 1900’s. One story says they were originally planted at Washington Park Arboretum and transplanted in UW’s quad later. Another version is that they were gifted to Seattle in 1912 by the mayor of Tokyo. Either way, they’re old.

The Route to View the Blossoms

When I say these trees draw a crowd, I’m not kidding. The University of Washington offers viewers a route to get to the Cherry Blossoms.

“4/1/22 update: Traffic congestion on campus is significant during cherry blossoms season and parking is limited. Please take light rail to the University District Station or park in the Central Parking Garage or Padelford Parking Garage.”- University of Washington

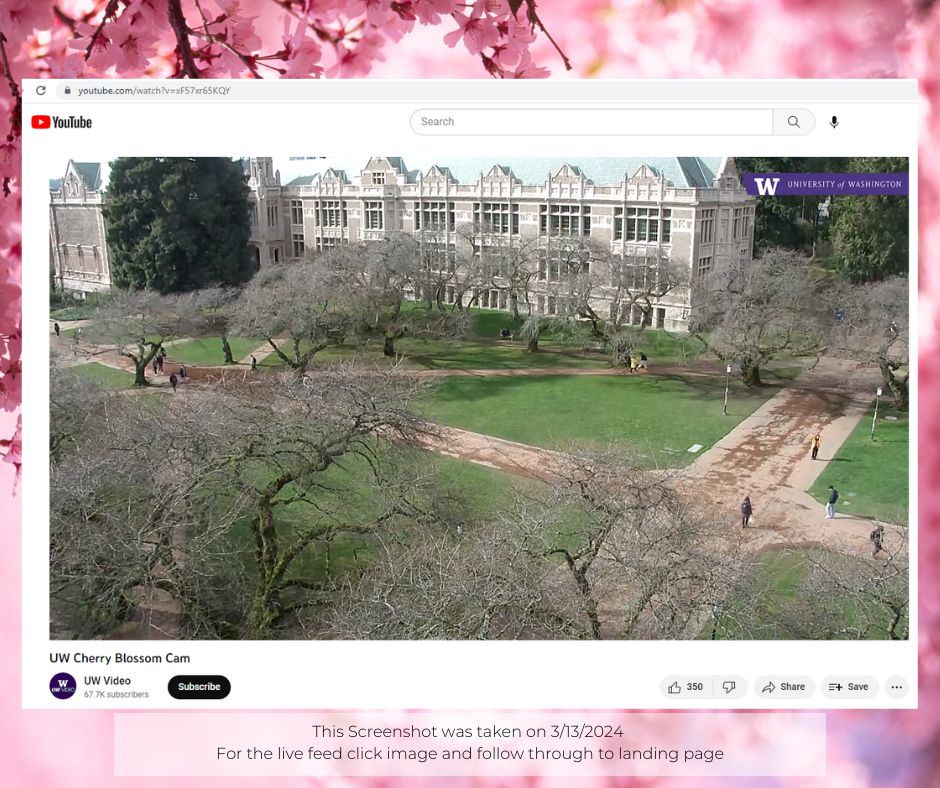

Check Out UW’s Live Webcam

To Remove any guesswork, head over to UW’s live webcam to see if the flowers have opened.

Want to Try to Avoid Crowds?

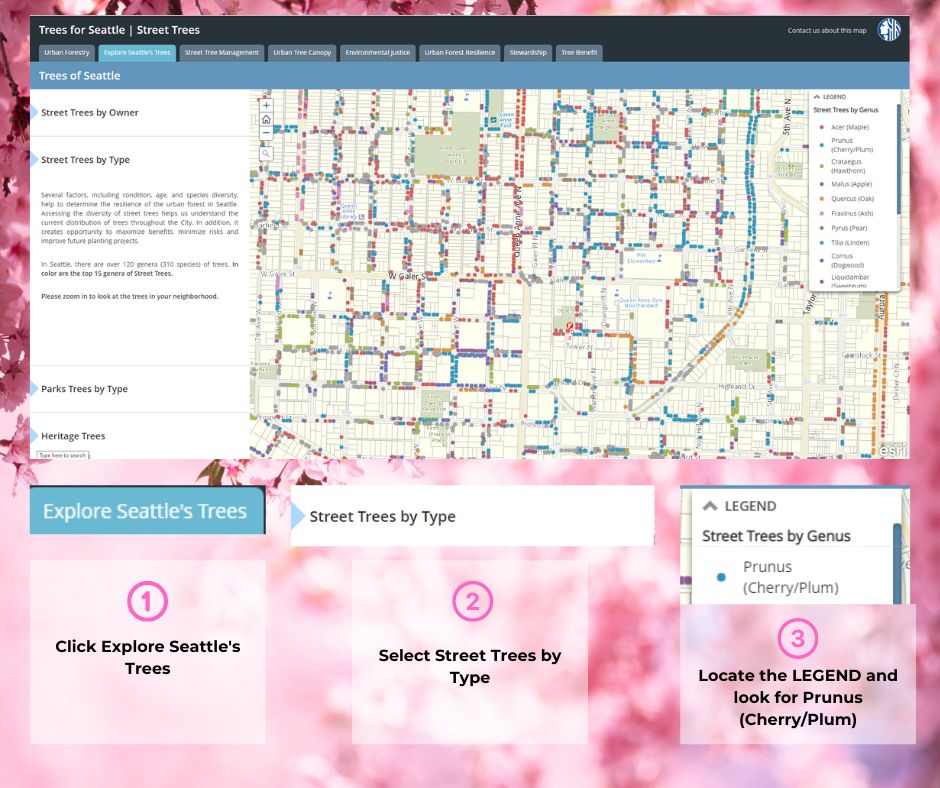

There are Cherry Blossom Trees planted throughout the greater Seattle Area. The Seattle Department of Transportation created an interactive map of trees across the city. To Find the cherry trees look for the spots marked Prunus (Cherry/Plum); just be aware the trees could be a plum tree. Happy Hunting!

They Won’t Last Long So See them ASAP!

Cherry blossoms are often thought to represent many things. The beauty and fragility of life, renewal, spring, love, hope, joy, and friendship. Many of the trees gifted to Seattle by Tokyo were offered to the city as a token of friendship. They are a beautiful sight to see and they don’t last long. One year a windstorm swept them away during peak bloom. So, make sure to stay on top of their socials if you want to see them in person this year!

By Kerriann Jenkins

The Secret to Selling Your Home

Is Making Your Home Less Personal the Secret to Selling It Quickly?

According to statistics, it seems so. However, like many things, there’s an art to it. When depersonalizing your home, it’s crucial to find a balance between making it less personal and not stripping away its warmth and humanity. The aim is to present your home as clean, inviting, and cozy, allowing potential buyers to envision a happy life in it. To achieve this, it’s recommended to declutter, organize, clean, and stage your home before listing photos are taken. Read a more in depth description of the secret to selling your home quickly below.

Here are the steps to achieve this:

Clean

While you may have grown accustomed to the lived in odors and oddities of your home, potential buyers may notice dust bunnies, kitchen grease, and mysterious stains. To avoid giving them a negative impression, take the time to deep clean your home before showcasing it.

Declutter

If you’re considering a move, decluttering should be a priority. It not only reduces the items you’ll need to transport but also creates a sense of openness, making your home appear larger. A decluttered home allows architectural features to shine and suggests that the property has been well-maintained.

Organize

Humans naturally find comfort in organized spaces. It provides a sense of understanding, safety, and control. To read more about this theory I recommend you read this article. Organization can be a key selling point during an open house. Additionally, an organized home looks appealing in listing photos, which are crucial for attracting potential buyers.

Staging

Staging is essential to help buyers connect with the stories your home tells. While you can hire a professional, you can also stage your home yourself by following the first three steps. Simplify spaces, give each area a clear purpose, and clean. Consider the market climate; in a seller’s market, you might not need extensive efforts to attract attention, but thoughtful staging can still lead to a bidding war and higher payouts.

Completing these four steps gives you a solid foundation for a quick sale, and that’s the secret to selling.

Your realtor will work with you to make additional recommendations based on the current market conditions. Overall, this proven method can fast-track you to a successful and timely sale.

Kerriann Jenkins

10 Steps to Make in the First 30 Days of Home Ownership

10 steps to make in the first 30 days of Home Ownership

Congratulations on achieving the milestone of home ownership! Now that you’ve successfully acquired your new residence, it’s time to ensure a smooth transition into this exciting chapter of your life. Here are 10 essential tasks and precautions to consider making in the first 30 days of home ownership:

Change the Locks and Secure Entryways

Changing the locks is such an important step to make when you first gain ownership of your new home. After all, you have no idea how many copies of the key have been made, or who they have been given out to. So as soon as you take possession of your new home, it’s crucial to change the locks on all exterior doors, and don’t forget about the garage and any storage on the property. You’ll want to secure those as well. Also, check out the hardware around your entry points and update them if need be. Additionally, If you have a smart lock system in your home change the password. Taking these small steps is a simple way for you to secure your home against any unwanted visitors.

Locate and Learn How to Operate Your Main Shutoffs

You never know when an emergency may strike. So, it’s best to be prepared for whatever may come. Once you’ve secured the outside of your home, you should work on familiarizing yourself with the inside of your home. To start, identify the location of essential utilities such as water, gas, and electricity shutoff valves. Knowing where these are and how to turn them off can prevent potential destruction of your hard-earned property.

Inspect and Update Safety Features

Another disaster preventative step to take is testing your carbon monoxide and smoke detectors, and your fire extinguisher. Replace batteries and equipment as needed and verify your extinguisher is up-to-date and easily accessible. It’s also a good idea to let all occupants know where you are storing the extinguisher.

Create a Maintenance Calendar

Regular maintenance can extend the life of your home’s systems and prevent costly repairs down the road. Accordingly, you should develop a schedule for routine maintenance tasks such as gutter cleaning, lawn care, HVAC checks, and so forth. This way you have made moves to combat extreme deterioration.

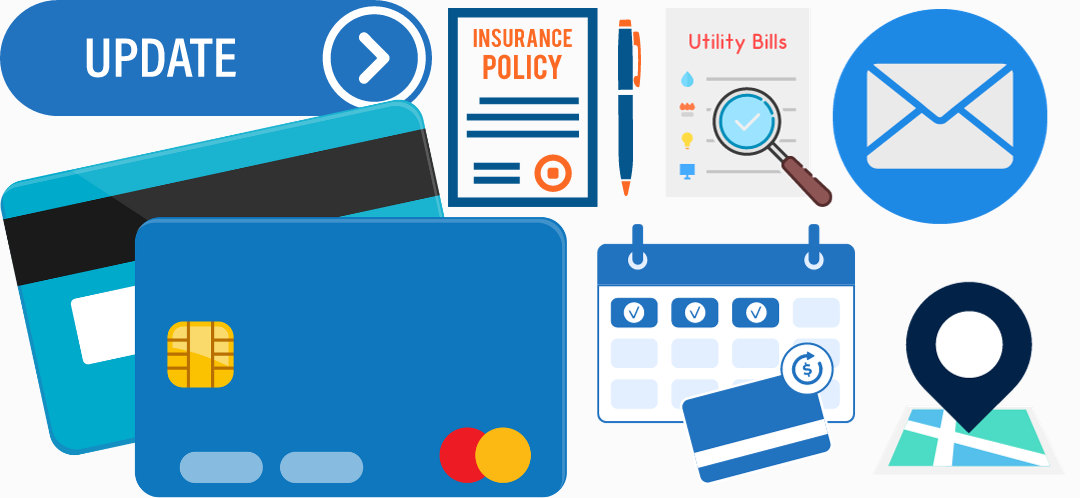

Update Your Address

Alright, you’ve moved! Now it’s time to let relevant entities know of your change of address. There are a handful of places you will want to give immediate notice to once the keys are in your hand. Your bank, Utility companies, subscription services, and insurance providers are a few of the more important ones.

Review Home Insurance

Now that I’ve mentioned it, let’s talk about your home insurance. Depending on the size of your move, you may need to add additional coverage options. Sit and evaluate what works for your new lifestyle and make the change to ensure your insurance adequately covers your property and belongings.

Meet Your Neighbors

Alright you bought your way into a community now it’s time to become part of it. Building positive relationships with your neighbors is a great way to start. Your neighbors can help make or break your experience in your new home. Introduce yourself and consider joining local community groups or social platforms. You never know when you may need an extra pair of watchful eyes or just somebody to borrow a cup of sugar from.

Deep Clean and Organize

Before settling in, give your new home a thorough cleaning. This is an excellent opportunity to organize and create a fresh start in your new space.

Energy Efficiency Audit

Familiarize yourself with the things in your home and swap them out with things that will best service you and your wallet. You would be surprised how big of a difference a small thing like upgrading to LED energy efficient lightbulbs can make for you. But at the same time, every opportunity to save is a good opportunity.

Plan for Emergencies

Create an emergency kit with essentials like flashlights, batteries, first aid supplies and a fireproof box to house your important documents. Establish an emergency evacuation plan and communicate it with all members of your household.

These 10 Steps to Make in the First 30 Days of Home Ownership Should Help Guide You Seamlessly Into Your New Chapter of Life

Remember, moving can be a challenging process, but this comprehensive list aims to simplify the first 30 days of home ownership for you. If you need assistance with services for your new home, don’t hesitate to reach out to your agent, as they can connect you with trusted vendors in their network. A reliable real estate agent is not only there to help you close the deal but also to provide ongoing support. Here in our office, we make it a point to recommend vetted home service providers. So if you’re a local, having difficulties getting connected with one, send us a message and we will direct you to one of our trusted vendors.

Kerriann Jenkins

Books of Winter

As winter’s chilly embrace settles in, it’s the perfect time to curl up with a warm blanket and a captivating book. In this season of introspection and cozy nights, literature becomes a gateway to other worlds, offering comfort and adventure from the comfort of your home. This month, our reading spotlight shines on two enthralling novels: “The Lost Bookshop” and “Prophet Song.” Each book is a treasure trove of suspense and adventure, promising to whisk you away on journeys filled with intrigue and excitement. Dive into these captivating reads and prepare to be immersed in the thrilling worlds they unfold. Visit there site here, www.sno-isle.org/mill-creek

The Lost Bookshop, by Woods, Evie

The Echo of Old Books meets The Lost Apothecary in this evocative and charming novel full of mystery and secrets. For too long, Opaline, Martha and Henry have been the side characters in their own lives. But when a vanishing bookshop casts its spell, these three unsuspecting strangers will discover that their own stories are every bit as extraordinary as the ones found in the pages of their beloved books.

Prophet Song, by Lynch, Paul

LONG LISTED FOR THE BOOKER PRIZE 2023

On a dark, wet evening in Dublin, scientist and mother-of-four Eilish Stack answers her front door to find two officers from Ireland’s newly formed secret police on her step. They have arrived to interrogate her husband, a trade unionist. Ireland is falling apart, caught in the grip of a government turning towards tyranny. As the life she knows and the ones she loves disappear before her eyes, Eilish must contend with the dystopian logic of her new, unraveling country. How far will she go to save her family? And what–or who–is she willing to leave behind? Exhilarating, terrifying and surprisingly intimate, Prophet Song offers a shocking vision of a country at war and a deeply human portrait of a mother’s fight to hold her family together.

Enjoy my reading choices!

blog written by Chasity Rodriguez

Social Media Director

12 Days of Indoor Winter Activities

12 Days of Indoor Winter Activities

It’s that time of year again—school’s almost out, and parents are on the lookout for ways to keep their kids entertained indoors, especially here in Washington where the weather keeps us cooped up. Growing up in my house, this season meant a ton of indoor fun, all thanks to my mom. From December 1st through the 24th, my mom put together the most engaging Christmas crafts and activities that kept me and my four siblings entertained for hours. In that same spirit, here’s a list of 12 indoor winter activities to beat your winter boredom.

Build an Indoor Snowman with Everlasting Snow Dough

No need to wait for snow outside. With baking soda and white hair conditioner, you can create your own snowman. Head to the dollar store, grab a storage container, and add winter-themed items for a sensory bin that lasts all winter. The fun thing about this dough is it feels a little icy to the touch, lending more to realism of building a snowman. But, it’s not going to melt on you and you can keep it as long as it is kept clean. Bonus Tip: If you’re not into DIY, you can always purchase a pre-made bucket of Floof instead.

Make a Cardboard Gingerbread House Garland

Use spare cardboard to cut out simple house shapes and add fine icing-like details with white puffy paint, or paint pens. Glue them to twine, and you’ve got a homemade gingerbread garland.

Graham Cracker Gingerbread House

Making a gingerbread house during the holiday season is a crowd-pleaser, with so many options on how to complete this project, you can’t go wrong. But because I was one of five kids, I tried to think of a budget friendly option; and I think this Graham Cracker Gingerbread House fits that bill. Depending on the ages of the kids you’re crafting with, you may want to consider putting this one together beforehand, and just letting them decorate the house itself.

Melted Holiday Crayons

I feel like every household with a child ends up with that inevitable bag of partially used crayon bits. This year, don’t toss out those crayon nubs. Instead, gather them up and melt them down using a silicone winter-themed mold to create magical rainbow crayons. Leave space for a hole and turn them into ornaments or classroom gifts. This is a quick, simple, and budget friendly craft that provides more fun after completing. After all, who wouldn’t want to draw with a magical color changing crayon.

Indoor Snowball Fight

Bring the snowball fight inside with indoor snowballs. They can be easily made with limited tools using things like a pom-pom maker or cardboard, yarn, and scissors. Here are links to a few helpful tutorials:

Cardboard Method Pom-Pom Tutorial

Build a Marshmallow Igloo

Use marshmallows and frosting to create an igloo. You can use a cup/bowl/toilet paper roll/plate as a base surface or connect marshmallows directly to one another. Let the kids enjoy nibbling on a few while they craft. Here’s a link to a video tutorial.

Upcycled Waterless Snow Globe

Instead of discarding used jars, clean them out and turn them into upcycled waterless snow globes. Get creative with salt for snow, pom-poms, and fishing line for a falling snow effect. You can use all kinds of found objects to fill your Snow Globe. So get innovative! Here are a few links to tutorials I found inspirational:

15 DIY Snow Globes That Are Completely Charming (and Totally Doable!)

DIY Pinecone Ornaments

This is a fun one that can involve an outdoor scavenger hunt to collect some supplies for it. I recommend that if you are planning to gather pinecones outdoors that you only take a small amount and leave plenty behind to fulfil its role in nature; or plan to gather a small amount from a few different areas.

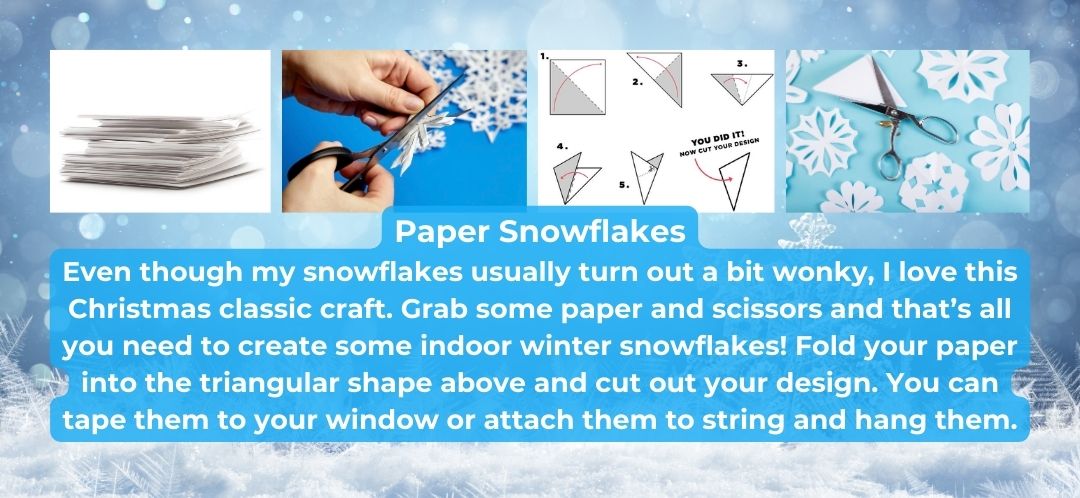

Traditional Paper Snowflakes

Grab paper or coffee filters for a classic night of snowflake making.

3D Paper Doily Snowflakes

Purchase paper doilies, a glue stick, and string to create intricate hanging snowflakes without scissors. Here is a link to a tutorial!

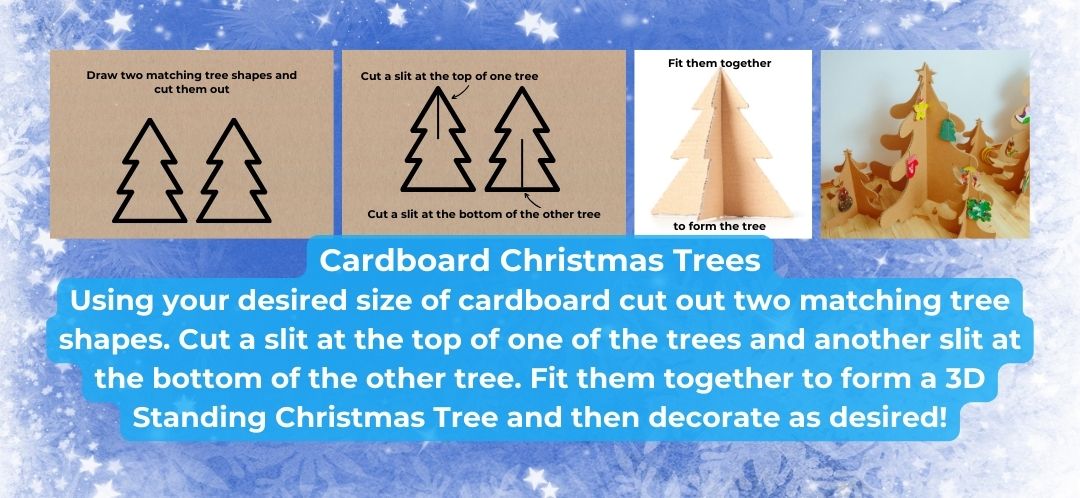

DIY Cardboard Christmas Trees

Cut simple tree shapes from cardboard and assemble them for a simple and cost-effective Christmas craft. Afterwards, decorate as you see fit! Here’s a link to a Cardboard Christmas Tree tutorial.

Christmas Cookies

We always ended our Christmas crafting extravaganza with baking and decorating Sugar Cookies for Santa. So, that’s how I’m going to end this blog. Here is a link to Taste of Home’s “Our Best Sugar Cookie Recipes.”

As we wrap up these 12 Days of Indoor Winter Activities, I hope these creative and budget-friendly ideas bring warmth and joy to your home during the chilly Washington winter.

Just like my mom did for our family, make this season a magical time filled with laughter and indoor adventures. Whether you’re building snowmen with Everlasting Snow Dough or creating upcycled waterless snow globes, these activities are sure to keep your kids entertained and create cherished memories. So, gather your supplies, embrace the festive spirit, and let the winter wonder unfold within the cozy walls of your home. Happy crafting and happy holidays!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link